Budget, Do We Need One as a Business?

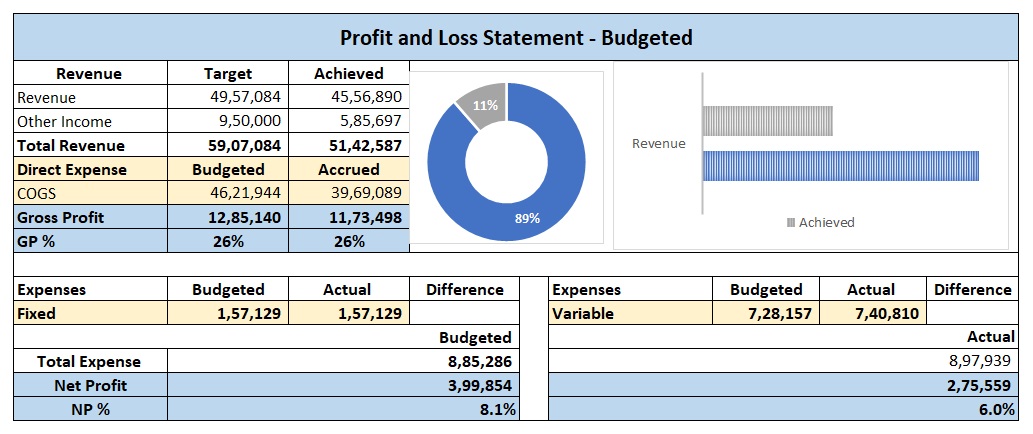

Our seasonal sales marked the highest achievement since our inception. However, the substantial outstanding payments to vendors have offset the positive impact of these sales, creating a significant fund shortage. This scenario is relatable for us at Leappoint, as we frequently encounter entrepreneurs grappling with similar fund dilemmas across various industries.

Or more so that Budgets are only for big companies, right? Wrong. Its absolutely mandatory for the healthy working of the businesses no matter how big or small.

In the dynamic world of small businesses, effective financial management is key to long-term success. One fundamental tool that plays a pivotal role in this aspect is budgeting. Despite the size of the company, the importance of budgeting cannot be overstated. This article explores the significance of budgeting for small businesses and how it contributes to their overall stability and growth.

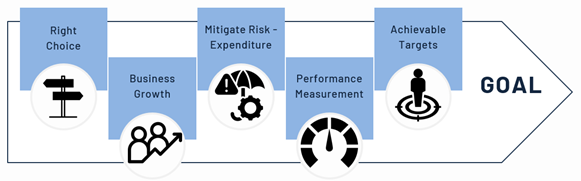

Financial Planning and Control: Budgeting serves as a roadmap for small businesses, providing a clear financial plan. It helps in setting realistic financial goals, allocating resources efficiently, and ensuring that expenses align with revenue. By establishing a budget, SME’s gain better control over their finances, allowing them to make informed decisions to achieve their objectives.

Resource Allocation and Prioritization:

Limited resources are a common challenge for small businesses. Budgets assist in identifying priorities and allocating resources strategically. Whether it’s investing in marketing, technology, or personnel, a well-structured budget enables small companies to allocate funds where they are most needed, optimizing their operations.

Effective Cash Flow Management:

SME’s often face cash flow fluctuations, making it crucial to monitor and manage finances diligently. A budget aids in forecasting cash flow, identifying potential challenges, and planning for lean periods. This proactive approach ensures that the company can navigate financial hurdles and maintain a healthy cash flow.

Alignment of Financial Goals and Performance Measurement:

Budgets enable small businesses to align their financial goals with overarching business objectives. Through regular monitoring of budget performance, companies can gauge their progress and identify areas for enhancement. This iterative process allows for timely adjustments, ensuring that financial strategies harmonize with the company’s growth trajectory.

Risk Mitigation:

In the volatile business environment, risks are inevitable. Budgets act as a risk management tool by highlighting potential financial pitfalls. Small businesses can identify and prepare for risks, making them more resilient in the face of economic uncertainties or unexpected challenges.

Why is effective business budgeting of utmost importance?

Informed Decision Making – Business owners can make well-informed decisions by utilizing budgeting as a tool.

Identification of Opportunities – It aids in recognizing potential avenues for business growth.

Enhanced Risk Visibility – Budgeting provides a clearer view of a business’s expenditures, helping owners identify and manage potential financial risks.

Performance Measurement – A well-crafted business budget plan establishes a clear benchmark, enabling owners to assess their business performance

Setting Concrete Targets – Budgets offer tangible figures that serve as the foundation for defining and achieving financial goals.

In summary, the significance of budgeting in small businesses is paramount. Serving as a foundational tool for financial planning, resource allocation, cash flow management, goal alignment, and risk mitigation, budgets empower small companies to navigate the intricacies of the business world.

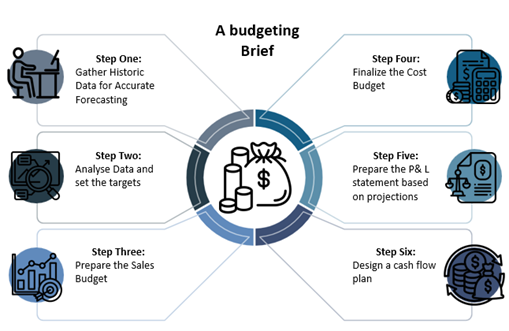

It is imperative to recognize the significance of formulating and concluding an accurate budget in this process. In our consulting experience, we have witnessed the favorable effects of a meticulously crafted budget on an organization’s efficiency and financial success. Prioritizing budgeting lays the groundwork for stability and sustainable growth, positioning small businesses for long-term success.