Electrifying Kerala : Understanding EV Charging Station Business in The State

With the escalating global concern over climate change and environmental degradation, the adoption of sustainable transportation solutions, such as electric vehicles (EVs), has become increasingly vital. Kerala, with its scenic landscapes and forward-thinking approach, stands poised to become a trailblazer in embracing electric mobility.

For entrepreneurs and organizations contemplating investment in this burgeoning field, this article serves as a comprehensive guide to navigate this electrifying journey.

The global EV industry projects an impressive Compound Annual Growth Rate (CAGR) of 49%. By 2030, EVs are expected to comprise 80% of two and three-wheelers, 40% of buses, and 30% to 70% of cars. According to global standards, there should be six public charging stations for every 20 EV cars. However, in India, the current ratio is 6 stations for every 135 EV cars, resulting in a 9X requirement for public charging station infrastructure. Presently, Kerala boasts over 1700 public EV charging stations, including KSEB’s single-pole stations for two-wheelers, with more stations continually being launched by various Charge Point Operators (CPO) across the state. These CPOs offer enticing franchise models, presenting an alluring and promising investment opportunity. They handle all aspects, from securing a dedicated KSEB connection to installation, daily operations, customer management, payment processing, and more. Some even promise a minimum annual return of 10% on investments if the station fails to generate projected profits.

Is it not a dream for any investor? Some have already invested, while others are seriously considering it. However, have you conducted your research?

In reality, is this a promising business? What are the pitfalls and hidden aspects of this industry?

As a business consultancy firm, we prioritize in understanding emerging business models in the market. Upon delving into this seemingly lucrative goldmine, our findings proved quite intriguing—reminding us that all that glitters is not gold!

The feasibility of any business depends on several critical parameters, including business profitability and the size of the Serviceable Obtainable Market.

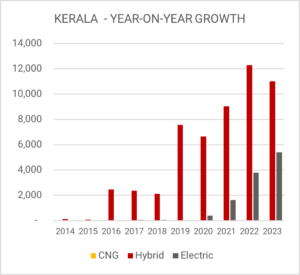

When examining the figures, leading EV car manufacturers like Tata, Suzuki, Hyundai, Mahindra, MG, and BYD have only sold 11,400 EV cars and 53,700 hybrid cars in Kerala since 2014.

This represents only 2% of the total number of cars sold in Kerala during the regarding types of EV charging infrastructure, there are three categories:

- Private Charging: Each EV car owner has a personal charging station at home.

- Semi-Public Charging: Shared charging for a restricted set of EV users in places like apartment complexes, office campuses, gated communities, and shopping malls.

- Public Charging: Stations open to all EV users.

The biggest competition for public station owners is the residential charging facility that most EV car owners have. Research has shown that 80% to 90% of car charging is done at residential facilities. There are even EV car owners who have never visited a public station because the need hasn’t arisen.

This primary problem is faced by station owners, where the average number of cars visiting their public charging stations ranges from 2 to 7 per day. Some days, not a single car turns up. Consequently, the revenue a station owner earns after deducting monthly expenses yields minimal profits, resulting in a break-even period of 10 to 12 years with current sales and profitability. The per unit cost of EV charging varies among players, and current charges and infrastructure may become obsolete in a short span of time.

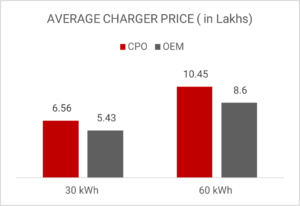

Considering industry trends, the average investment required to start an EV charging station is analysed. Currently, the most commonly placed chargers are 30 kWh and 60 kWh. The average investment for a 30 kWh single charger station ranges from 10 lakhs to 15 lakhs when partnering with a CPO.

This investment includes necessary software (charger management system – CMS) for managing the charger and tracking traffic, along with basic station infrastructure. Additional initial setup costs of 20,000 to 30,000 rupees are also required.

CPOs provide guidance on the charger’s capacity to be installed and offer general marketing and customer management support, freeing the investor from operational duties.

However, it’s crucial to note that CPOs are not manufacturers of these chargers, often sourcing them from various Indian and Chinese OEMs. Investors can opt to source chargers directly from these OEMs, which may be more financially feasible, as they offer competitive prices compared to CPOs. The investor may have to dedicate more time and effort to manage the station when purchasing directly from an OEM.

Establishing an EV charging station business in Kerala presents both opportunities and challenges. While the demand for public charging infrastructure exists, the current market volume may not ensure immediate profitability. Technological advancements and competition from residential charging facilities are additional factors to consider. Conducting in-depth research and collaborating with experienced players may help navigate the complexities of the industry and create a sustainable business model. As the EV market continues to evolve, staying updated on emerging trends and customer preferences is essential to drive success in this electrifying venture.