Navigating the Cash Flow Conundrum: Why Profits on Paper Aren't Enough for SMEs

As seasoned business consultants, we have witnessed firsthand the triumphs and tribulations of small and medium-sized enterprises (SMEs). While profitability often serves as a beacon of success, it’s imperative to recognize that healthy profits on paper don’t always translate to adequate cash flow—a reality that can spell trouble for SMEs if left unaddressed.

The scenario of “profits in paper but not enough cash” is a precarious predicament faced by many SMEs, and it’s one that requires astute navigation to ensure long-term viability and growth. In this blog post, we’ll delve into the nuances of this challenge and explore actionable strategies for SMEs to overcome it.

Understanding the Discrepancy: Profitability vs. Cash Flow

At the heart of the issue lies a fundamental discrepancy between profitability and cash flow. While profitability represents the surplus generated from revenue exceeding expenses over a specific period, cash flow refers to the movement of cash in and out of a business during the same period. It’s entirely possible for a business to report healthy profits while simultaneously experiencing cash flow shortages.

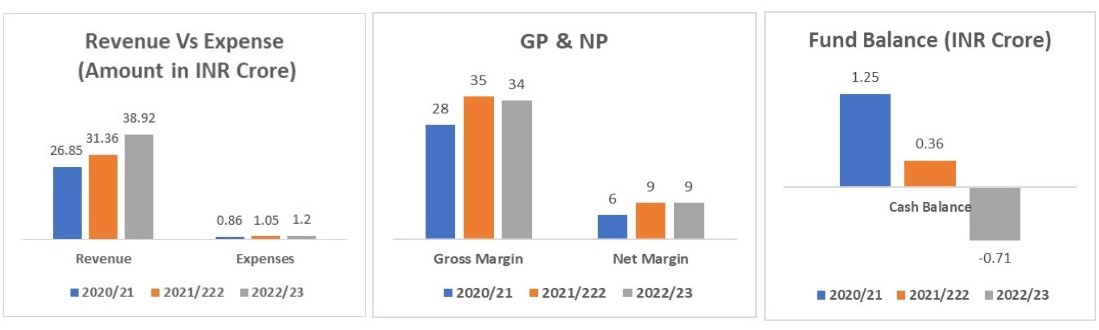

The scenario of “profits on paper but not enough cash” is a common challenge faced by many SMEs. This predicament arises due to several factors, high inventory levels, excessive overhead costs, and inadequate cash management practices. While profitability might seem promising based on accounting metrics, the actual liquidity needed to cover day-to-day operations may be lacking.

Several factors contribute to this misalignment

Timing Differences: Revenue recognition and cash inflows may not synchronize due to delayed customer payments or extended credit terms, leading to a gap between reported profits and actual cash receipts.

Working Capital Management: SMEs may tie up substantial funds in inventory or accounts receivable, limiting available cash for day-to-day operations.

Fixed Expenses: Regardless of revenue fluctuations, fixed expenses such as rent, salaries, and loan repayments demand regular cash outflows, which can strain liquidity during lean periods.

Navigating the Cash Flow Conundrum: Strategies for Success

For SMEs grappling with the challenge of profits on paper but insufficient cash, proactive measures are essential to mitigate risk and ensure financial resilience.

Cash Flow Forecasting: Develop robust cash flow projections to anticipate ebbs and flows in cash availability. By forecasting cash inflows and outflows with precision, SMEs can proactively manage liquidity and identify potential shortfalls before they escalate into crises.

Working Capital Optimization: Implement prudent working capital management practices to streamline operations and maximize cash efficiency. This may involve negotiating favourable payment terms with suppliers, incentivizing early customer payments, and optimizing inventory levels to minimize excess carrying costs.

Expense Management: Scrutinize fixed and variable expenses to identify opportunities for cost reduction and optimization. Leveraging technology and automation tools can streamline processes, improve efficiency, and free up cash for strategic investments.

Credit Management: Adopt a proactive approach to credit management to minimize the risk of bad debts and accelerate cash inflows. Conduct thorough credit assessments on customers, establish clear credit policies, and implement robust collections processes to minimize delinquencies and improve cash flow.

Financial Planning and Contingency Preparedness: Develop comprehensive financial plans that account for various scenarios and contingencies. Maintain adequate cash reserves to weather unforeseen challenges and capitalize on opportunities for growth and expansion.

Conclusion

While profitability serves as a vital indicator of business success, it’s imperative for SMEs to recognize that profits on paper alone are not sufficient to sustain long-term viability.

By prioritizing cash flow management, implementing proactive strategies, and fostering a culture of financial discipline, SMEs can navigate the cash flow conundrum with confidence and position themselves for sustainable growth and prosperity in the competitive landscape.