Why Your Business Needs a Rainy-Day Fund. Storms Happen!!!

Roads are good for the economy and definitely for our vehicles, but have we thought about the drastic hiccups we face during the interim phase of these expansion plans. In an unexpected turn of events, a local retail apparel business owner reached out to us after experiencing a significant decline in sales due to a government-mandated road widening project. This unforeseen contingency had never been part of their risk management strategy, leaving them unprepared for the drastic impact on foot traffic and overall business performance and the inevitable cash crunch. They had to let go few of their team members, forced to take fund from external sources with a very high interest rates to keep the good terms with their suppliers. As the construction dust settles, this situation serves as a stark reminder of the importance of proactive planning for seemingly unlikely disruptions.

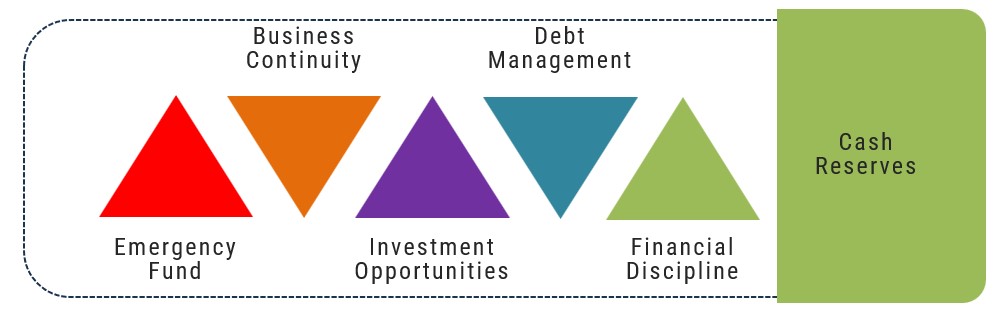

Cash reserves are a cornerstone of financial stability for small businesses, providing the liquidity needed to weather unforeseen challenges and capitalize on growth opportunities.

Benefits of Cash Reserves

- Managing Cash Flow Fluctuations

- Operational Stability

- Creditworthiness

In any business, cash flow can be highly unpredictable. Market conditions, seasonal demand variations, and changes in supplier terms can all cause cash flow instability. Having a cash reserve ensures that a business can cover operational costs, such as payroll, rent, and utilities, during lean periods.

Maintaining a healthy cash reserve can enhance a business’s creditworthiness. Lenders and investor’s view businesses with solid cash reserves as lower-risk, potentially leading to better financing terms.

Challenges Faced Without Cash Reserves

- Cash Flow Issues

- Increased Financial Stress

- Higher Financing Costs

Without cash reserves, businesses may struggle to cover expenses during periods of low revenue. This can lead to late payments, damaging relationships with suppliers and employees.

Operating without a financial cushion can increase stress for business owners, impacting decision-making and long-term planning. The need to constantly manage cash flow can divert attention from strategic growth initiatives.

Businesses without cash reserves often rely on short-term, high-interest loans to cover immediate needs. This can lead to a cycle of debt that is difficult to break, further straining financial resources.

One of our Client, an apparel manufacturer, exemplifies the importance of cash reserves. Here’s how our joint approach to cash reserves contributed to their success:

The first step – Building Reserves

We set a goal to save enough to cover six months of operating expenses. They automated monthly transfers to a dedicated reserve account and carefully managed the budget to prioritize savings.

Handled a Market Downturn – A lean patch in the otherwise sale season

When a few major clients reduced orders due to an economic downturn, the orders faced a significant drop, consequently the revenue. Thanks to the cash reserves, they continued to pay their employees and suppliers on time, maintaining good relationships and operational stability.

Investing in Technology

During a period of strong sales, identified an opportunity to invest in new technology that would increase order efficiency. With cash reserves available, they purchased and implemented the new software without needing external financing, resulting in long-term cost savings and enhanced competitiveness.

Seizing a Growth Opportunity

As the market started to rebound, the client could utilize the fund to revamp their brand visibility with targeted marketing plan. significantly boosting their market share. Prior to cash reserves, these marketing campaigns were carried out with external funds paying high interests eating up the difference in revenue bought about by these advertising campaigns.

Planning for Cash Reserves:

For small businesses building and maintaining cash reserves requires discipline and strategic planning.

- Regularly Review Financials

- Assess Financial Needs

- Set Savings Goals

- Budgeting

By Continuously monitor the cash flow statements, balance sheets, and income statements and regular reviews helps identify trends and potential issues early, allowing us to make informed decisions.

The cardinal rule is to determine the amount needed to cover at least three to six months of operating expenses. Consider fixed and variable costs, and account for seasonal fluctuations in revenue.

Establish clear savings goals based on our financial assessment. Automate transfers to a dedicated account to ensure consistent contributions, regardless of business performance and implement a budget that prioritizes building cash reserves.

Cash reserves are essential for the sustainability and growth of small businesses. They provide the financial stability needed to manage cash flow fluctuations, seize opportunities, and mitigate risks. By setting clear savings goals, budgeting wisely, and consistently building reserves, small businesses can enhance their resilience and pave the way for long-term success.